Choosing the right accounting software can be a game-changer in the fast-paced business world. With options like FreshBooks, QuickBooks, and Xero vying for attention, it’s crucial to understand how each platform can uniquely support your financial management needs. Whether you’re a small startup, a growing enterprise, or somewhere in between, this comparison will delve into the key features, usability, and pricing of these leading software choices. Let’s navigate the intricacies of FreshBooks vs QuickBooks vs Xero, empowering you to make an informed decision that aligns perfectly with your business goals.

Table of Contents

Overview of the Three Platforms

FreshBooks – Simplifying Small Business Accounting

FreshBooks, known for its user-friendly interface, primarily caters to small businesses and freelancers. With a focus on simplicity and intuitive design, it’s an ideal choice for those who might be new to accounting software or prefer a more streamlined approach to managing their finances.

QuickBooks – A Comprehensive Solution for Diverse Needs

QuickBooks, a product of Intuit, is renowned for its comprehensive features, which are suitable for businesses of all sizes. From detailed financial reporting to payroll services, QuickBooks offers a range of tools that can be customized to meet the diverse needs of its users, making it a popular choice for a broad spectrum of businesses.

Xero – Cloud-Based Innovation for Modern Businesses

Xero stands out with its cloud-based structure, offering robust features for on-the-go entrepreneurs and growing companies. Its strong emphasis on collaboration and integration with a multitude of third-party apps positions Xero as a forward-thinking choice for businesses looking to leverage the cloud for accounting.

Key Features Compared

Invoicing and Billing

Invoicing and billing are the lifeblood of financial management; let’s see how each software fares in this essential function. FreshBooks offers customizable invoice templates, which are easy to use and send. QuickBooks, on the other hand, provides more detailed options for invoicing, including automatic invoice reminders. Xero’s invoicing system is highly efficient, allowing for quick invoice creation and tracking.

Expense Tracking and Management

Effective expense tracking can make or break a business’s financial health – a comparison of how each platform handles this task reveals some differences. FreshBooks allows easy entry and tracking of expenses, suitable for small businesses. QuickBooks offers more detailed expense categorization, which is beneficial for larger companies with complex accounting needs. Xero provides real-time expense tracking, giving businesses up-to-the-minute insights into their spending.

Payroll Processing Capabilities

Payroll processing is a complex task, and our comparison delves into the efficiency and ease offered by FreshBooks, QuickBooks, and Xero. FreshBooks integrates with third-party payroll services, whereas QuickBooks has an in-built payroll function that is comprehensive and widely used. Xero’s payroll system is also integrated into its platform, offering automated payroll calculations and filings.

Usability and Interface

Ease of Setup and Use

A user-friendly setup is critical for any accounting software – here’s how our contenders stack up. FreshBooks offers a straightforward setup, making it easy for users to get started quickly. QuickBooks, with its more extensive features, requires a bit more time to set up but provides comprehensive guidance throughout the process. Xero, being cloud-based, has a seamless setup process and a clean interface that is easy to navigate.

Mobile App Functionality and Access

In an age of mobility, the effectiveness of mobile applications is a significant factor in software selection. FreshBooks offers a mobile app that is intuitive and allows users to manage their finances on the go. QuickBooks’ mobile app is robust, offering almost all the functionalities available on the desktop version. Xero’s app also stands out for its usability and range of features accessible from a mobile device.

Pricing and Plans

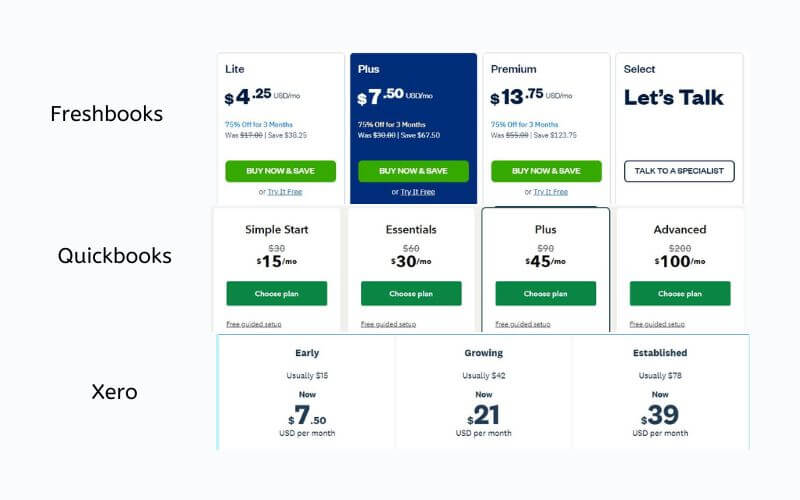

Comparing Cost-Effectiveness

Budget considerations are paramount for businesses; we compare the pricing structures of FreshBooks, QuickBooks, and Xero. FreshBooks offers tiered pricing, starting with a basic plan ideal for freelancers and scaling up for larger businesses. QuickBooks also provides various pricing tiers, accommodating the needs of small to large enterprises, with its more advanced features priced higher. Xero’s pricing is competitive, offering a range of features at each price point, making it a cost-effective choice for businesses of various sizes.

Plan Options and Scalability

As businesses grow, their accounting needs evolve – we examine how scalable each software is with respect to changing business sizes. FreshBooks scales well for small to medium-sized companies, with easy upgrades to more feature-rich plans. QuickBooks is highly scalable, offering solutions that cater to tiny businesses all the way up to large corporations. Xero is also scalable, particularly attractive for companies that are growing rapidly due to its cloud-based infrastructure.

Customer Support and Community

Support Channels and Responsiveness

Reliable customer support can be a lifesaver; we assess the support options provided by each software. FreshBooks offers support via email and phone and is known for its responsive and helpful customer service. QuickBooks provides a comprehensive support network, including live chat, phone support, and a vast online community. Xero’s support includes email, an extensive online help center, and active community forums.

Community Resources and Learning Materials

An active user community and abundant learning resources are invaluable – let’s see what each platform offers. FreshBooks has a helpful blog and resource center that provides tips and advice for small businesses. QuickBooks offers a wealth of learning materials, including tutorials, webinars, and user forums. Xero provides a robust set of online resources, including guides, videos, and a dedicated help center.

Integrations and Add-Ons

Extending Functionality Through Integrations

The ability to integrate with other tools and services adds versatility to accounting software – a comparison of integration capabilities. FreshBooks integrates with a variety of apps, streamlining various business processes. QuickBooks offers a wide range of integrations, from payment processing to CRM systems, enhancing its utility. Xero stands out with its extensive ecosystem of integrations, allowing businesses to connect a multitude of applications seamlessly.

Availability and Usefulness of Add-Ons

We explore the various add-ons available for FreshBooks, QuickBooks, and Xero and their impact on business operations. FreshBooks offers essential add-ons catering to specific business needs. QuickBooks’ add-ons include advanced features like inventory management and advanced reporting. Xero’s add-ons cover a broad spectrum, from HR to sales, providing comprehensive business solutions.

Security and Data Protection

Keeping Financial Data Safe

In our digital world, data security in accounting software is not just a feature but a necessity. FreshBooks, QuickBooks, and Xero all employ robust security measures, including encryption and secure data centers, to protect sensitive financial information. Regular security audits and compliance with industry standards ensure that your data remains safe.

Making the Right Choice for Your Business

Choosing between FreshBooks, QuickBooks, and Xero depends on various factors, including business size, industry, and specific needs. By understanding the unique features and capabilities of each platform, you can select the software that aligns best with your business goals and streamlines your financial processes.

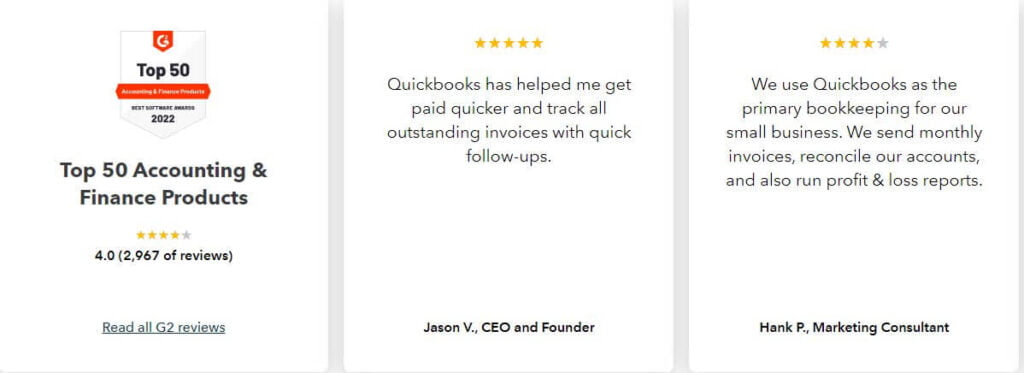

User Reviews and Testimonials

What Users Are Saying

Real user experiences can offer valuable insights; we delve into what users of FreshBooks, QuickBooks, and Xero have to say. FreshBooks is often praised for its user-friendly interface and excellent customer service. QuickBooks users appreciate the software’s comprehensive features and robust reporting capabilities. Xero, meanwhile, receives accolades for its strong cloud-based functionality and ease of use, particularly for on-the-go access.

QuickBooks Reviews

- Graham Windsor: Criticizes the receipt capture software for taking poor-quality pictures and not extracting critical information. He also mentions the difficulty in exporting data, describing it as a potential nightmare in case of an audit.

- Bill, North Hollywood, CA: Shares his experience with QuickBooks Desktop, noting a significant price increase when switching to the online Essentials version, leading to dissatisfaction.

- Melissa, Deerfield Beach, FL: Describes a negative experience with QuickBooks regarding an invoice payment scam and the lack of support from QuickBooks in resolving the issue.

- Gayle, Ashland, OR: Expresses frustration with the integration process into QuickBooks Online (QBO), finding the program cumbersome and inefficient.

- Shannon, Orlando, FL: Reports problems with payroll correction in QuickBooks and unsatisfactory customer service during attempts to resolve the issue.

Xero Reviews

- A user who switched from QuickBooks to Xero appreciated Xero’s cloud-based capabilities and found it user-friendly, enabling their virtual team to work effectively.

- Another user praised Xero for its ease in syncing bank feeds and reconciling transactions and the helpful rule feature for setting routine transactions.

- A business owner found Xero’s user interface business-oriented and simple, making accounting more enjoyable.

- However, some users expressed dissatisfaction with Xero’s customer service, finding it difficult to speak to a representative when needed.

- A user mentioned the issue with the FreshBooks/Xero integration, which stopped working around 2017, with both companies blaming each other for the problem.

FreshBooks Reviews

- Orne F. (C-Level, Technology Industry): Praised FreshBooks as the “best tool for accounting hands down,” highlighting its in-app estimates and proposals. He appreciated the Chart of Accounts for providing a comprehensive overview. Still, he mentioned that time tracking could be better suited for his teams.

- Alejandra P. (Sales Marketing, Construction Industry): Valued FreshBooks for its ability to manage daily accounting activities and user-friendly design. She liked the tax algorithm and invoicing features. Still, she criticized the recent platform update and mentioned issues with electronic payments and bank integrations.

- Alexander A. (Sales Marketing): Expressed satisfaction with FreshBooks, citing its ease of use and valuable tools. He appreciated the cloud-based system, automatic tax calculations, and the mobile application. However, he noted limitations in bank integrations and some missing functions in the mobile app.

Making the Right Choice for Your Business

Choosing the right accounting software for your business is a decision that should be taken with seriousness. Each platform – FreshBooks, QuickBooks, and Xero – has its unique strengths and might be the best fit depending on your specific business needs, size, and industry. It’s essential to weigh the features, ease of use, pricing, and scalability of each option. Remember, what works best for one business might not be the ideal solution for another.

Summary and Closing Thoughts

In wrapping up this detailed exploration of FreshBooks, QuickBooks, and Xero, it’s evident that each platform has its unique strengths and offerings. Choosing which software to choose hinges on understanding these differences and aligning them with your business’s needs and goals.

FreshBooks emerges as an exceptional choice for small businesses and freelancers who value simplicity and ease of use. Its intuitive interface and straightforward functionality make accounting tasks more manageable, especially for those with extensive accounting experience.

Note: If you are seeing this Note, FreshBooks is currently offering a Great Deal.

With its comprehensive features, QuickBooks is a robust solution for businesses requiring detailed financial tracking and reporting. Its versatility suits various companies, from small startups to larger enterprises.

With its cloud-based architecture, Xero offers a modern solution for businesses seeking real-time financial updates and seamless integrations. It’s particularly beneficial for companies that prioritize mobility and collaboration.

Ultimately, your specific business requirements should drive the choice between FreshBooks, QuickBooks, and Xero. Consider factors like the scale of your operations, the complexity of your accounting needs, and the level of support and integrations you require.

Investing in the right accounting software is not just about managing your finances; it’s about empowering your business to grow and thrive in a competitive landscape. So, take the time to evaluate each option, leverage free trials, and choose a platform that meets your current needs and scales with your future aspirations.

In conclusion, whether you choose FreshBooks for its simplicity, QuickBooks for its comprehensive features, or Xero for its innovative cloud-based approach, the right accounting software is a crucial tool in your business arsenal, paving the way for streamlined financial management and informed business decisions.

Frequently Asked Questions (FAQs)

Which software is best for small businesses?

FreshBooks is often recommended for small businesses due to its simplicity and ease of use. However, Xero is also a good option for small businesses looking for cloud-based solutions.

Can I switch from one software to another easily?

Switching between software can be a complex process, depending on the amount and complexity of financial data. It’s advisable to consult with a professional or use the migration tools provided by these platforms.

Are these software options suitable for non-profit organizations?

Yes, all three platforms can be configured to meet the needs of non-profit organizations, though QuickBooks offers specific non-profit features that might be particularly useful.

Do these platforms support multi-currency transactions?

Yes, FreshBooks, QuickBooks, and Xero all support multi-currency transactions, making them suitable for businesses operating internationally.

Can I integrate these software with e-commerce platforms?

Yes, FreshBooks, QuickBooks, and Xero offer integrations with various e-commerce platforms, enhancing the efficiency of online sales and financial management.

Are there any free versions or trials available?

All three platforms offer free trials, allowing you to test their features before committing to a subscription. However, there are no completely free versions for long-term use.

How user-friendly are these software for those without accounting experience?

FreshBooks and Xero are exceptionally user-friendly, even for those without prior accounting experience. QuickBooks, while slightly more complex, offers comprehensive learning resources to ease the learning curve.

Do these platforms offer multi-user access?

Yes, FreshBooks, QuickBooks, and Xero allow multi-user access, with varying levels of user permissions and roles, to ensure secure and efficient collaboration.

How does data migration work when switching between these platforms?

Data migration can be a complex process, but each of these platforms offers resources and tools to facilitate the transfer of data. It’s recommended that you seek professional assistance for a smooth transition.

Is custom reporting available on all three platforms?

Yes, FreshBooks, QuickBooks, and Xero offer custom reporting features, allowing businesses to tailor reports to their specific needs.

Can I manage inventory using these software?

QuickBooks offers advanced inventory management features. Xero also provides inventory tracking. FreshBooks, while less comprehensive in this area, can be integrated with other inventory management tools.

Are there any limitations to the number of transactions or clients?

Each platform has different plans that cater to varying levels of transaction volumes and client numbers. It’s essential to choose a plan that fits your business’s scale.

Are these platforms compliant with accounting standards?

Yes, FreshBooks, QuickBooks, and Xero are compliant with standard accounting practices and regulations, making them reliable choices for businesses.

Can I track time and projects with these software?

Both FreshBooks and QuickBooks offer time tracking and project management features. Xero also provides project tracking capabilities, primarily through its integrations.

Is customer service available in multiple languages?

QuickBooks and Xero offer customer support in multiple languages. FreshBooks primarily provides support in English, but its ease of use makes it accessible to a broad user base.

How often are these platforms updated?

All three platforms are regularly updated to improve functionality, add new features, and ensure security. Cloud-based solutions like Xero often update more frequently.

Additional resources

For information about a tool that integrates well with accounting software, explore :